How do you calculate cash forecast?

Direct Forecasting Method

Now, you can calculate your daily cash flow by subtracting total expenditures from income. Since you're creating a forecast, you can use historical data to understand your traditional cash flow, growth, and expenditures to better forecast daily cash flow.

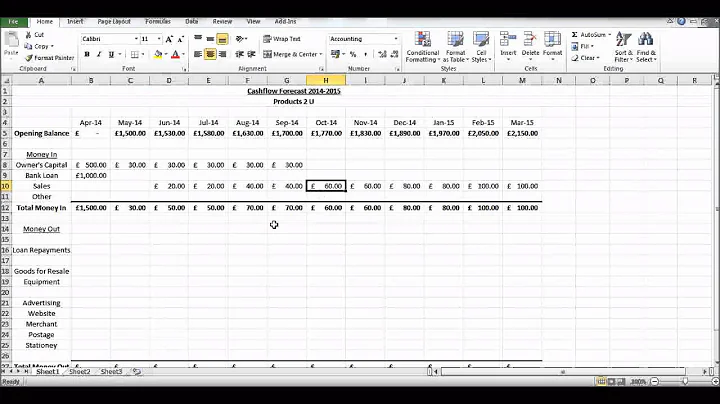

For each week or month in your cash flow forecast, list all the cash you have coming in. Have one column for each week or month, and one row for each type of income. Start with your sales, adding them to the appropriate week or month. You might be able to predict this from previous years' figures, if you have them.

The direct method is for short-term forecasting and shows cash needs and working capital fund requirements. It is done by analyzing upcoming payments, receipts, credits, and debts. The indirect method is for long-term forecasting and shows the amount of cash required to pay for long-term projects and growth strategies.

1 Know your cash inflows and outflows

The first step to preparing a cash flow forecast is to identify and categorize your sources and uses of cash.

Cash flow projections show the amount of cash on hand at the beginning and at the end of each month. For example, Company XYZ has the following projected income and expenses for the month of January: At the beginning of January, a company has $10,000 in cash. Income for the month is projected to be $30,000.

Forecasts often include projections showing how one variable affects another over time. For example, a sales forecast may show how much money a business might spend on advertising based on projected sales figures for each quarter of the year.

Cash flow forecasting, also known as cash forecasting, estimates the expected flow of cash coming in and out of your business, across all areas, over a given period of time. A short-term cash forecast may cover the next 30 days and can be used to identify any funding needs or excess cash in the immediate term.

A cash flow forecast is a document that helps estimate the amount of money that'll move in and out of your business. It also includes your projected income and expenses. Cash flow forecasts typically cover the next 12 months, but can also be used for shorter periods of time – like a week or a month.

A Cash Forecast is a tool for recording how much money you are likely to have coming in and out of your business at any point. You will be required to submit a Cash Forecast with your final Start Up Loan application. Cash Flow Forecast template. Free instant download.

Which method of cash forecasting is more accurate?

Direct forecasting may be the best option if you have a small business with limited cash flow history. However, indirect forecasting can provide a more comprehensive view of your future cash flow needs if you have complex revenue structures or many transactions. Review your business needs and data availability.

- Prepare historical data.

- Calculate cash flow drivers.

- Build a cash flow model.

- Validate and refine your model.

- Visualize and communicate your results.

- Update and monitor your forecast.

- Here's what else to consider.

A three-way forecast, also known as the 3 financial statements is a financial model combining three key reports into one consolidated forecast. It links your Profit & Loss (income statement), balance sheet and cashflow projections together so you can forecast your future cash position and financial health.

A 12-month cash flow forecast shows a company its expected liquidity situation, i.e. how high its income and expenses will be in the next 12 months. This corresponds to long-term liquidity planning and is an important planning tool for start-ups as well as for companies already firmly established in the market.

The limitations of cash flow forecasts include being unable to account for changing costs, and the accuracy of when money comes into the business. Miscalculations will affect the business which could result in debt.

Forecasting involves making predictions about the future. In finance, forecasting is used by companies to estimate earnings or other data for subsequent periods. Traders and analysts use forecasts in valuation models, to time trades, and to identify trends.

- Choose your forecasting method. ...

- Identify what you're selling. ...

- Determine your sales prices and quantities. ...

- Multiply your prices and quantities. ...

- Factor in your costs. ...

- Consider your inventory.

Indeed, good forecasting is always an iterative process. Defining the cone broadly at the start maximizes your capacity to generate hypotheses about outcomes and eventual responses. A cone that is too narrow, by contrast, leaves you open to avoidable unpleasant surprises.

Planning for the future, assessing future performance, predicting future goal accomplishments, and identifying cash shortages are the uses of a cash flow forecast.

Examples of cash inflow include money earned from selling products and returns on any investments. Conversely, cash outflow can consist of your operating expenses, debts, and other liabilities.

What are the disadvantages of cash flow forecast?

Disadvantages of cash flow forecasts

It can't predict the future of your business with absolute certainty. Nothing can do that. Just as a weather forecast becomes less accurate the further ahead it predicts, the same is true for cash flow forecasts. A lot can change, even in 12 months.

- Start with the Opening Balance. ...

- Calculate the Cash Coming in (Sources of Cash) ...

- Determine the Cash Going Out (Uses of Cash) ...

- Subtract Uses of Cash (Step 3) from your Cash Balance (sum of Steps 1 and 2)

Forecasting cash flow is typically the responsibility of a business's finance team.

Cash forecasting is the process of predicting near future cash flows, including both inflows and outflows, based on current business conditions and past performance.

For cash flow forecasting to be as accurate as possible, your financial forecasting needs to be updated every time something changes that will impact your cash flow. For example, two situations that will significantly affect your cash flow forecast include late payments and increased sales.